Five Problems with Raising the Minimum Wage

Louisiana has the second highest poverty rate in the nation.

Governor John Bel Edwards has suggested raising the minimum wage to put more money in people’s pockets, but is it really that simple?

Here are five points to consider before taking steps to raise the minimum wage:

- Raising the minimum wage costs jobs.

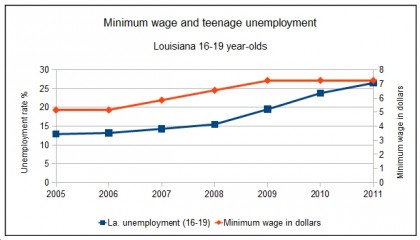

A report by the American Action Forum – a policy institute offering research, analysis and solutions to policy problems – found a $1 increase in the minimum wage leads to a 1.48 percent increase in unemployment.

How can a $1 raise have such negative consequences? It is easier to understand if you put yourself in a business owner’s shoes.

Imagine you opened a small retail store in Louisiana last year. You make enough money to remain open, but as a new business trying to take off, you are on a very tight budget.

You have approximately $42,000 a year to spend on labor, which you divide between 5 part-time employees. Each worker clocks about 20 hours a week at minimum wage, so after you factor in the taxes you have to pay on top of each dollar, the annual cost of your employees is about $41,500.

A $1 increase in the minimum wage will increase labor costs by nearly $6,000 a year, moving the annual cost of your employees to the neighborhood of $47,200. You do not have the budget to accommodate this extra $5,200, so what do you do?

These higher labor costs will force some employers to find cheaper ways to get the job done. Employees that are not essential could be laid off, or computers, such as self-checkout machinery, could replace the role of people in the workplace.

Destroying jobs is not a productive way to fight poverty.

- A minimum wage increase could make the state less competitive.

If the minimum wage is increased, do not assume that low-paying jobs will be all that is at stake. The repercussions could be much greater.

In the south, Texas, Mississippi, Alabama, Tennessee and Kentucky do not have minimum wages above the federal minimum. If a business relies on a large number of minimum wage employees, will it locate or remain in Louisiana when so many other states in its region have lower labor costs?

If a business relocates, that puts all employees at risk of losing their job, not just those making minimum wage. And if a business is looking to open or expand in the southeast, and plans to depend on many low-wage employees, even a minor increase to Louisiana’s minimum wage could send the state to the back of the list.

Losing businesses – and jobs – certainly will not lift people above the poverty line.

- Raising the minimum wage will have a marginal effect on the poor.

According to a report by the Heritage Foundation, only 22 percent of minimum wage earners live below the poverty line. Rather, it is mostly students who occupy low paying jobs.

The Heritage Foundation’s report found about 62 percent of minimum wagers are enrolled in school during fall, winter and spring. Further, the report noted about 1/3 of minimum wage earners have not finished high school, about 1/4 only have their high school degree and about 2/5 have taken college classes, but not yet graduated (many in this category are college students working part-time).

So while raising the minimum wage may or may not lift people above the poverty line, it may instead set many students back by costing them the opportunity to gain work experience that could help them earn higher salaries after they complete their education – experience that could ultimately keep them above the poverty line later in life.

- The benefits of increasing the minimum wage may be neutralized by a higher cost of living.

The IHS Global Insight macroeconomic model – often used by government agencies, financial institutions and manufacturers when making economic forecasts – shows increases in labor costs are often passed onto consumers.

For example, following a 14 percent increase to the minimum wage in California, Chipotle raised their prices by 14 percent.

Why does this happen? Back to the retail store owner scenario from earlier. If you do not want to lay off any of your employees or cut their hours, and you can’t make substantial cuts to other expenses, you would have to bring in an additional $5,200-$6,000 a year. So, your prices would have to increase.

At best for low-wage workers, they keep their jobs, but pay a proportionate higher cost of living. Has anything really been accomplished?

And at worst for them, if businesses throughout the state are toying around with raising prices and cutting labor expenses, some low-wage workers could be put in an even worse situation. These workers could lose their jobs, and then face a higher cost of living with increases in consumer prices.

- Employers have a better understanding of employee productivity than the government.

Jobs are different. There are entry-level jobs that require attention to detail or a lot of paper work, and others that offer more free time and flexibility.

Since different jobs require different amounts of education, skill, experience, concentration, physical energy and commitment, employers should be the ones that determine how to properly compensate employees.

Investments are made based on value produced. A business owner is inclined to pay an employee for the value they will bring to the company.

When a business pays workers below their value, they can leave for better opportunities and the business is harmed by losing productive workers. Conversely, if a business pays workers above their value, the business may lose money. While not perfect, this market is the best mechanism for wages to be fairly determined.

While Louisiana does have serious problems arising from widespread poverty, raising the minimum wage is not a quick and harmless fix.

Raising the minimum wage risks putting individuals, businesses and the entire state economy in a worse position to advance a goal – helping low income households – that may not even be accomplished.

More jobs and opportunities for advancement are found in business-friendly environments. According to a 2015 report by the Tax Foundation, Louisiana’s business tax climate ranks 35th in the nation. Perhaps Louisiana lawmakers would have more success in advancing economic opportunity if they focused on addressing this obstacle to economic growth.